The Wallace Insurance Agency Can Be Fun For Everyone

Wiki Article

4 Easy Facts About The Wallace Insurance Agency Described

Table of ContentsNot known Facts About The Wallace Insurance AgencyThe Buzz on The Wallace Insurance AgencyHow The Wallace Insurance Agency can Save You Time, Stress, and Money.5 Simple Techniques For The Wallace Insurance AgencyThe Ultimate Guide To The Wallace Insurance Agency5 Simple Techniques For The Wallace Insurance AgencyThe Wallace Insurance Agency for DummiesThe Wallace Insurance Agency Can Be Fun For Anyone

These strategies also supply some protection component, to assist guarantee that your recipient obtains financial payment must the unfortunate occur throughout the period of the plan. Where should you begin? The easiest method is to start considering your top priorities and needs in life. Here are some concerns to obtain you began: Are you looking for higher hospitalisation protection? Are you concentrated on your family members's well-being? Are you trying to save a good sum for your kid's education and learning demands? Most individuals begin with one of these:: Against a history of rising medical and hospitalisation costs, you might want wider, and higher coverage for medical expenditures.Ankle sprains, back strains, or if you're knocked down by a rogue e-scooter biker., or usually up to age 99.

The Buzz on The Wallace Insurance Agency

Depending on your protection plan, you obtain a swelling amount pay-out if you are completely impaired or seriously ill, or your loved ones receive it if you pass away.: Term insurance coverage gives insurance coverage for a pre-set time period, e - Insurance policy. g. 10, 15, twenty years. Due to the shorter insurance coverage duration and the absence of cash money worth, costs are generally reduced than life strategiesWhen it grows, you will certainly obtain a swelling amount pay-out. Money for your retirement or youngsters's education and learning, check. There are 4 typical kinds of endowment plans:: A plan that lasts about 10 years, and gives annual money benefits on top of a lump-sum amount when it grows. It commonly consists of insurance policy coverage versus Complete and Long-term Impairment, and death.

Things about The Wallace Insurance Agency

You can pick to time the payout at the age when your youngster goes to university.: This gives you with a regular monthly income when you retire, normally in addition to insurance coverage coverage.: This is a way of saving for temporary goals or to make your cash job harder against the pressures of rising cost of living.

The 20-Second Trick For The Wallace Insurance Agency

While getting different plans will provide you extra extensive insurance coverage, being overly secured isn't a good thing either. To stay clear of undesirable financial stress and anxiety, compare the policies that you have versus this checklist (Liability insurance). And if you're still unsure concerning what you'll need, exactly how a lot, or the sort of insurance to get, seek advice from an economic expertInsurance is a long-term dedication. Constantly be sensible when determining on a strategy, as changing or ending a plan prematurely typically does not yield financial benefits.

The Wallace Insurance Agency Can Be Fun For Everyone

The ideal component is, it's fuss-free we immediately work out your cash flows and provide cash ideas. This short article is meant for details only and needs to not be trusted as financial advice. Before making any choice to purchase, market or hold any type of financial investment or insurance policy product, you need to inquire from an economic consultant concerning its viability.Spend only if you understand and can check your investment. Expand your investments and stay clear of investing a big section of your money in a solitary product company.

The 45-Second Trick For The Wallace Insurance Agency

Life insurance coverage is not constantly one of the most comfortable topic to talk about. Yet similar to home and automobile insurance, life insurance policy is necessary to you and your family's economic security. Moms and dads and functioning grownups typically require a type of life insurance policy policy. To help, let's explore life insurance in a lot more detail, how it functions, what value it might give to you, and exactly how Bank Midwest can aid you discover the best policy.

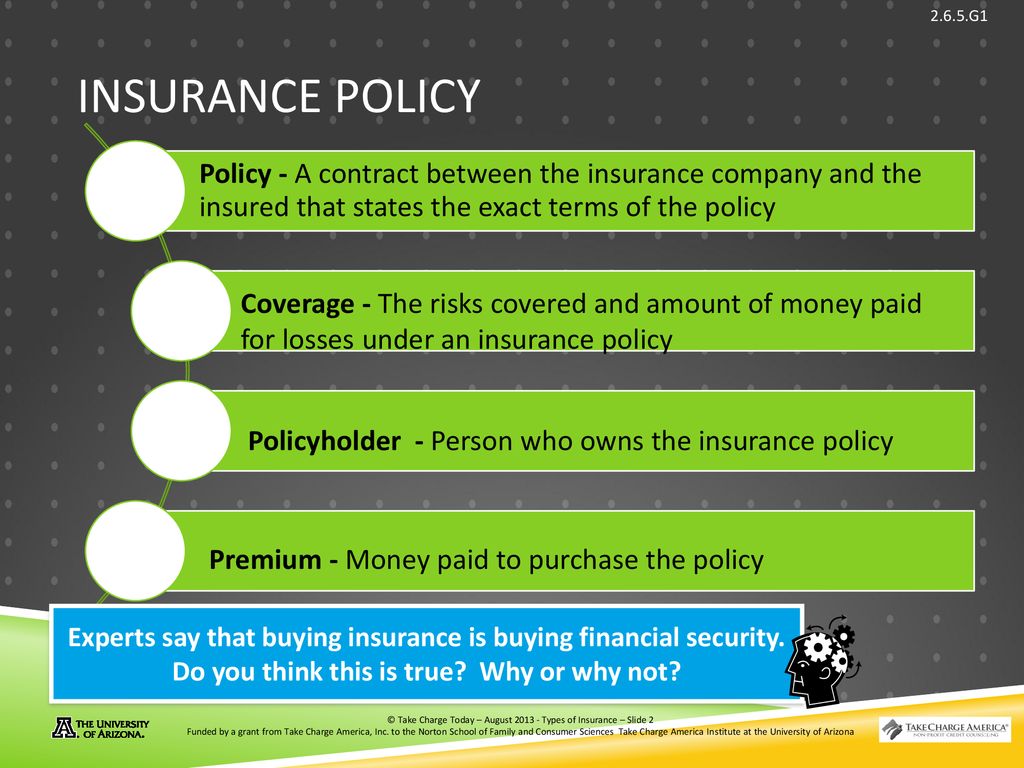

It will certainly help your family pay off financial obligation, receive earnings, and get to major financial objectives (like university tuition) in the occasion you're not below. A life insurance policy policy is fundamental to intending out these economic factors to consider. In exchange for paying a regular monthly costs, you can get a set amount of insurance policy coverage.

The The Wallace Insurance Agency Statements

Life insurance policy is appropriate for practically every person, also if you're young. People in their 20s, 30s and also 40s commonly overlook life insurance coverage.The even more time it requires to open up a policy, the even more danger you face that an unanticipated event could leave your family without protection or financial assistance. Depending on where you're at in your life, it's crucial weblink to know exactly which kind of life insurance is ideal for you or if you need any type of at all.

The Wallace Insurance Agency Fundamentals Explained

A property owner with 25 years staying on their home loan might take out a policy of the same size. Or let's say you're 30 and strategy to have children quickly. Because instance, authorizing up for a 30-year plan would certainly secure your costs for the following three decades.

Report this wiki page